Life Insurance in and around Bastrop

Life goes on. State Farm can help cover it

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

Check Out Life Insurance Options With State Farm

No one likes to fixate on death. But taking the time now to arrange a life insurance policy with State Farm is a way to demonstrate love to your loved ones if death comes.

Life goes on. State Farm can help cover it

Now is the right time to think about life insurance

Why Bastrop Chooses State Farm

Having the right life insurance coverage can help loss be a bit less complicated for the people you're closest to and allow time to grieve. It can also help cover bills and other expenses like ongoing expenses, phone bills and childcare costs.

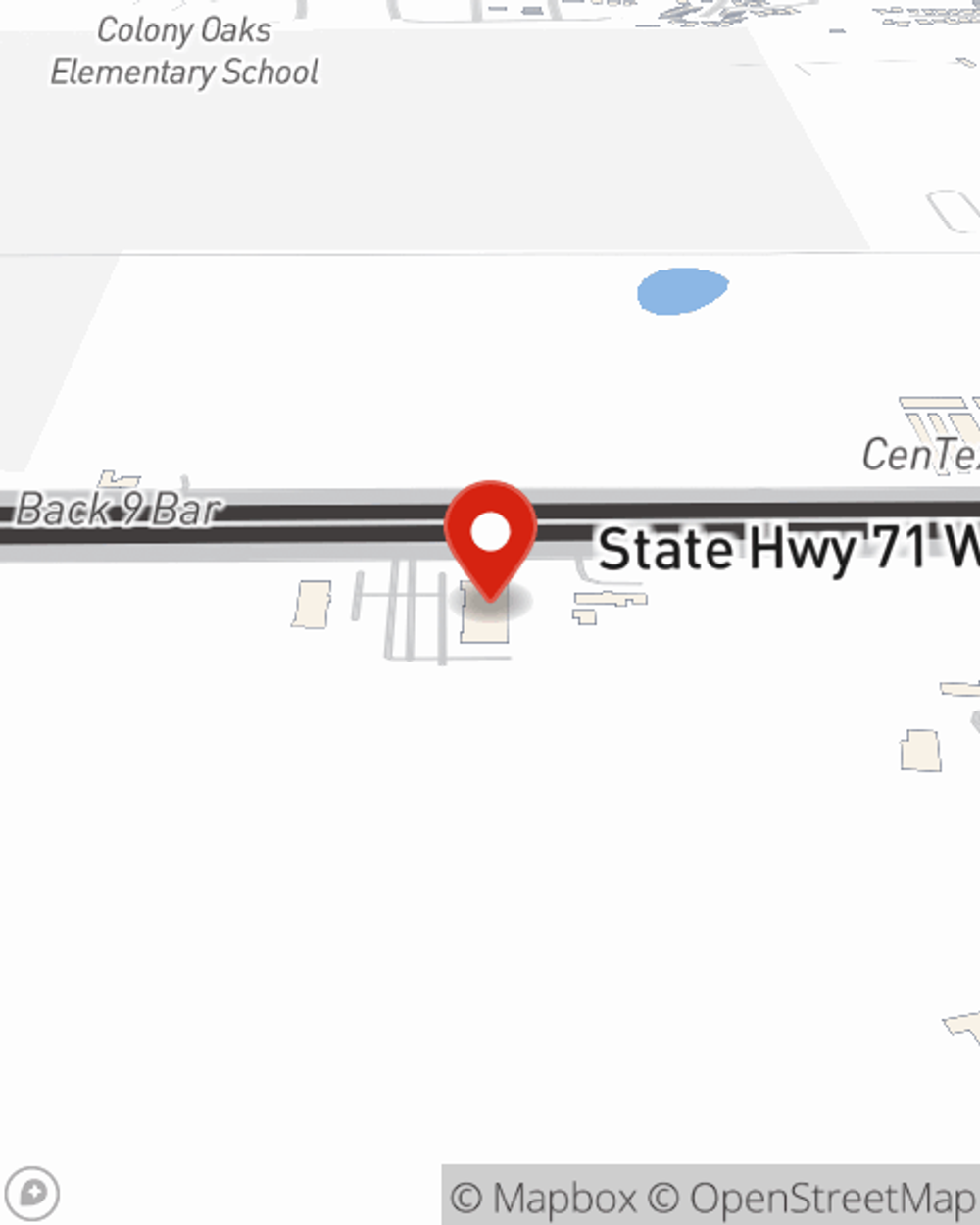

Don’t let concerns about your future stress you out. Visit State Farm Agent Lori Tuggle today and find out how you can rest easy with State Farm life insurance.

Have More Questions About Life Insurance?

Call Lori at (512) 581-3939 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

Lori Tuggle

State Farm® Insurance AgentSimple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.